Mexico Fintech Market 2025 Edition Size, Growth, Trends & Report 2033

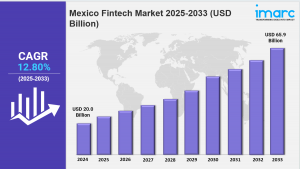

Mexico fintech market size reached USD 20.0 Billion in 2024 and is expected to reach USD 65.9 Billion by 2033, at a CAGR of 12.80% during 2025-2033.

BROOKLYN, NY, UNITED STATES, July 10, 2025 /EINPresswire.com/ -- Market Overview 2025-2033Mexico fintech market size reached USD 20.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 65.9 Billion by 2033, exhibiting a growth rate (CAGR) of 12.80% during 2025-2033. The Mexico fintech market is witnessing significant expansion, fueled by growing digital adoption, favorable government regulations, and a rising unbanked population. Key trends include the surge in mobile payments and digital lending, with major players emphasizing financial inclusion and leveraging advanced technologies such as AI and blockchain to enhance service delivery.

Key Market Highlights:

✔️ Strong expansion driven by digital transformation and financial inclusion

✔️ Growing usage of mobile wallets and online lending platforms

✔️ Increasing focus on AI, blockchain, and regulatory support for innovation

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-fintech-market/requestsample

Mexico Fintech Market Trends and Drivers:

The Mexico fintech market is experiencing significant structural transformation, driven by the rapid adoption of digital payment systems and mobile wallets. As smartphone penetration increases and internet infrastructure improves, both consumers and businesses are transitioning away from cash-based transactions. Fintech platforms are playing a crucial role in providing financial access to individuals who lack connections to traditional banking institutions, offering secure and convenient alternatives for everyday financial activities.

Digital payments have become a central component in expanding Mexico fintech market share, especially with the rise of e-commerce and contactless payment preferences. Retailers, service providers, and delivery platforms are integrating digital payment solutions to streamline operations and enhance customer experience. This development is extending beyond urban centers, reaching rural areas where access to financial services has historically been limited.

Lending services are also evolving within the Mexico fintech market. Non-bank digital lenders are enabling quicker access to credit for consumers and micro, small, and medium-sized enterprises (MSMEs). These platforms utilize alternative credit scoring mechanisms, relying on behavioral and transactional data rather than traditional credit histories. This model allows a broader segment of the population to participate in the formal credit economy, supporting financial inclusion and small business development.

As digital lending grows, collaborations between fintech companies and established financial institutions are becoming more common. These partnerships aim to combine the technological agility of fintech with the regulatory experience and infrastructure of traditional banks, thereby expanding reach and service delivery across different population segments.

Technological advancements continue to influence the Mexico fintech market. Blockchain applications, biometric verification, and data encryption are increasingly utilized to improve transaction security and system transparency. These innovations contribute to the credibility and reliability of digital financial services in the country.

Regulatory frameworks have also played a key role in market expansion. Mexico’s Fintech Law, introduced in 2018, established a formal legal structure for the sector, setting standards for licensing, data protection, and consumer safety. Government-led initiatives promoting financial literacy and open banking are further supporting market adoption. As infrastructure, regulation, and consumer readiness align, the Mexico fintech market is positioned for continued expansion. The sector is attracting both domestic and international investment and is emerging as a competitive landscape for financial innovation in Latin America.

Checkout Now: https://www.imarcgroup.com/checkout?id=22146&method=980

Mexico Fintech Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Deployment Mode:

• On-premises

• Cloud-based

Breakup by Technology:

• Application Programming Interface

• Artificial Intelligence

• Blockchain

• Robotic Process Automation

• Data Analytics

• Others

Breakup by Application:

• Payment and Fund Transfer

• Loans

• Insurance and Personal Finance

• Wealth Management

• Others

Breakup by End User:

• Banking

• Insurance

• Securities

• Others

Breakup by Region:

• Northern Mexico

• Central Mexico

• Southern Mexico

• Others

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=22146&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Elena Anderson

IMARC Services Private Limited

+1 631-791-1145

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.